Income Tax Department New Recruitment 2024 | Latest Income Tax Jobs 2024 |Income Tax New Jobs 2024 | Income tax Department has releases various Vacancy in all over India . Get all Details related to Income Tax Recruitment in this Blog.

| Organization name | Income Tax Department |

| Application Mode | Online |

| Who can apply | Male & Female Both |

| Location | All Over India candidates can apply |

Important Dates

- Apply Start Date- 22 Dec 2024

- Last Date to apply – 19 Jan 2024

Application Fee :-

| Categories Name | Application Fee |

|---|---|

| Gen, OBC | Rs.200 |

| EWS , ST , SC | Rs.200 |

Vacancy Details

| Post Details | Number of Posts |

|---|---|

| Inspector of Income Tax-ITI | 14 Posts |

| Stenographer Grade-II (Steno) | 18 Posts |

| Tax Assistant | 119 Posts |

| Multi- Tasking Staff | 137 Posts |

| Canteen Attendant | 03 Posts |

Selection Process

- On Interview Basis

Salary Scale

| Post Name | Salary Scale |

|---|---|

| Inspector of Income-tax (ITI) | Level 7 (Rs.44,900-1,42,400) |

| Stenographer Grade-II (Steno | Level 4 (Rs.25,500-81,100) |

| Tax Assistant (TA) | Level 4 (Rs.25,500-81,100) |

| Multi-Tasking Staff (MTS) | Level 1 (Rs.18,000-56,900) |

| Canteen Attendant (CA) | Level 1 (Rs.18,000-56,900) |

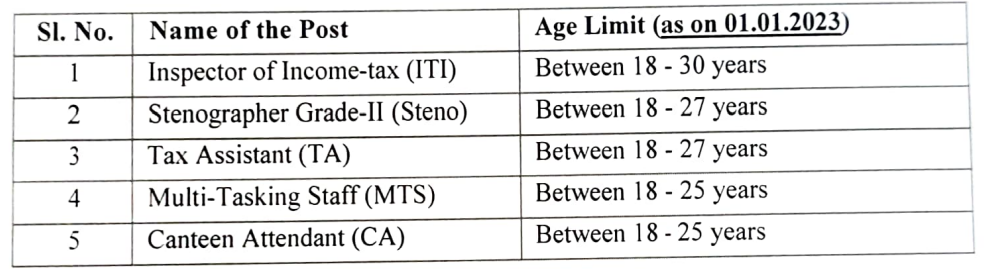

Age limit

- Relaxation of age: As per Government of India instructions for meritorious sportsperson. relaxation of upper age limit up to a maximum of 5 years (10 years in case of SC/ST candidates) may be allowed.

Qualification

| Name of the Post | Essential Educational & Other Qualifications |

|---|---|

| Inspector of Income Tax (ITI) | A Degree from recognized University or equivalent qualification |

| Stenographer Grade II (Steno) | 12th class pass or equivalent from a recognized Board or University |

| Tax Assistant (TA) | A Degree of a recognized University or equivalent qualification |

| Multi- Tasking Staff (MIS) | Matriculation or Equivalent |

| Canteen Attendant (CA) | Matriculation or Equivalent |

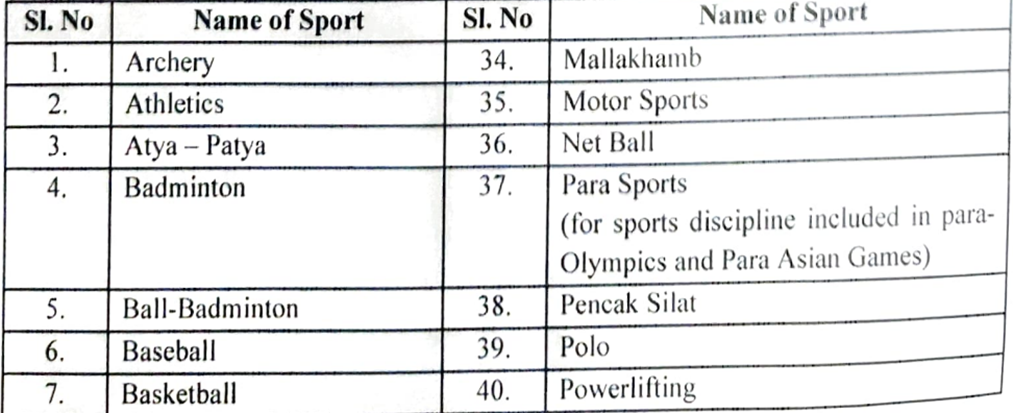

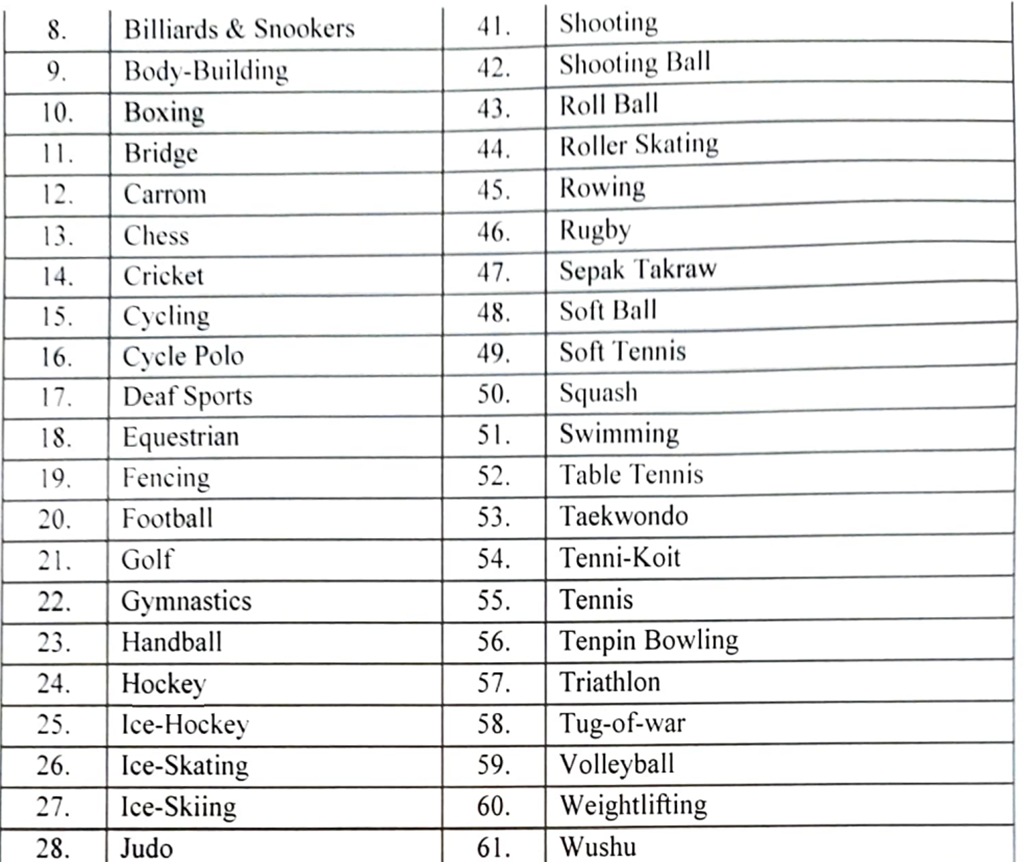

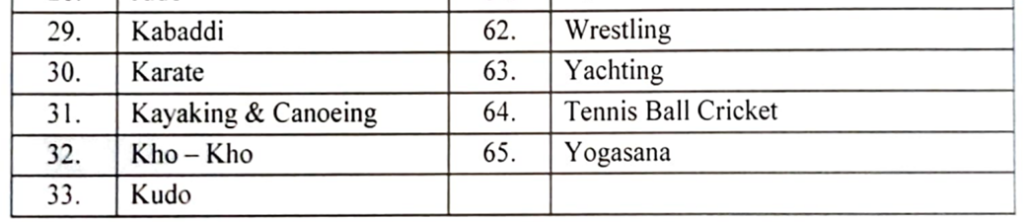

LIST OF GAMES/SPORTS Required for Qualification –

LIST OF AUTHORITIES COMPETENT T0 AWARD CERTIFICATES ON ELIGIBILITY FOR RECRUITMENT OF SPORTSPERSON:

| Competition | The authority competent to award certificates on eligibility for recruitment of sportsperson |

|---|---|

| International Competition | Secretary of the National Federation of the Game concerned |

| National Competition | Secretary of the National Federation or Secretary of the State Association of the Game concerned |

| Inter-University Tournaments | Dean of Sports or other officer in Overall charge of sports of the University concerned |

| National/Sports/Games for Schools | Director or Additional/Joint or Deputy Director in overall charge of sports/games for Schools in the Directorate of Public Instructions/Education of the State concerned |

| Physical Efficiency Drive | Secretary or other Officer in overall charge of Physical Efficiency in the Ministry of Education & Social Welfare, Government of India |

Detailed Info Step by Step for Income Tax Recruitment

Important Required Links :

INCOME TAX Recruitment Process for Sportsperson

- Notification of Vacancies: The Income Tax Department releases notifications regarding job vacancies for sportspersons through leading newspapers, the department’s official website, and other prominent employment portals. These notifications include details such as the number of vacancies, eligibility criteria, application process, and important dates.

- Eligibility Criteria: Candidates must meet certain eligibility criteria to apply for the positions advertised by the Income Tax Department. This typically includes educational qualifications, age limit, and sports achievements. Each recruitment notification specifies the exact eligibility requirements.

- Application Process: Interested candidates need to apply as per the instructions provided in the official notification. They usually have to fill out an application form available on the department’s website or through offline modes as specified. Along with the application form, candidates are required to submit necessary documents such as educational certificates, sports certificates, identity proof, and photographs.

- Selection Process: The selection process for sportspersons in the Income Tax Department generally involves the following stages:

- Physical Fitness Test: Candidates may be required to undergo a physical fitness test to assess their physical capabilities.

- Sports Trials: Candidates are evaluated based on their performance in sports trials conducted by a selection committee. The trials assess various aspects of the candidate’s sporting abilities such as skill, technique, agility, and overall fitness.

- Document Verification: After the trials, shortlisted candidates are called for document verification to confirm their eligibility and authenticity of the provided documents.

- Interview/Personality Test: Some recruitment processes may include an interview or personality test to evaluate the candidate’s suitability for the position.

- Medical Examination: Candidates who clear the above stages are typically required to undergo a medical examination to ensure they meet the required medical standards.

- Final Selection: The final selection of candidates is based on their performance in all stages of the selection process. A merit list is prepared, and candidates are offered employment based on their ranking in the merit list, subject to fulfillment of all eligibility criteria and verification of documents.

- Training: Selected candidates undergo training as per the norms of the Income Tax Department to acquaint them with their roles, responsibilities, and departmental procedures.